Home / Current Affairs

Civil Law

Usufructuary Mortgage and Limitation Period

« »29-Dec-2025

|

"In usufructuary mortgages, the limitation period for redemption begins not from the date of mortgage creation but from the date of payment or tender of mortgage money." Justices B.V. Nagarathna and R. Mahadevan |

Source: Supreme Court

Why in News?

The bench of Justices B.V. Nagarathna and R. Mahadevan in the case of Dalip Singh (D) Through LRs. & Ors. v. Sawan Singh (D) Through LRs. & Ors. (2025) dismissed the appeal filed by mortgagees and affirmed that in usufructuary mortgages, the right to seek redemption arises from the date of payment of mortgage money, not from the date of mortgage creation.

What was the Background of Dalip Singh (D) Through LRs. & Ors. v. Sawan Singh (D) Through LRs. & Ors. (2025) Case?

- The appellants (original plaintiffs) were mortgagees of disputed property measuring 114 Kanals and 4 Marlas of land situated at Village Tamkot, Tehsil Mansa, District Bathinda.

- The property was mortgaged by the ancestors of the respondents (original defendants).

- The respondents/defendants filed an application under Section 6 of the Redemption of Mortgage Act, 1913 for redemption of the mortgaged property.

- The Collector allowed the redemption application vide order dated 17.09.1975 in favor of the respondents/defendants.

- Aggrieved by the Collector's order, the appellants/plaintiffs filed Civil Suit No. 291/1975 challenging the redemption order.

- The Trial Court decreed the suit in favor of the plaintiffs vide order dated 22.09.1976, holding that the application for redemption was barred by limitation and set aside the Collector's order.

- The respondents/defendants filed a first appeal before the Additional District Judge, Bathinda in Civil Appeal No. 107/R.T.-99 of 76/77, which was dismissed vide order dated 24.12.1980.

- The respondents/defendants then filed Regular Second Appeal No. 1053/1981 before the High Court of Punjab and Haryana.

- The High Court allowed the appeal vide order dated 18.09.2001, holding that the right to redeem the mortgage was not barred by limitation and that fresh cause of action accrued based on adjustments made to the loan from income arising from the land.

- The appellants/plaintiffs challenged this before the Supreme Court in Civil Appeal No. 6084/2002, which was allowed vide order dated 16.04.2009 on procedural grounds.

- The case was remanded to the High Court for re-adjudication as the High Court had failed to formulate substantial questions of law before allowing the appeal.

- After formulating substantial questions of law, the Punjab and Haryana High Court again allowed the appeal in favor of respondents/defendants vide order dated 25.01.2010.

- The High Court relied upon Ram Kishan and Ors. v. Sheo Ram and Ors. (2008) and restored the Collector's order dated 17.09.1975, dismissing the plaintiffs' suit.

What were the Court's Observations?

- The Supreme Court noted that the High Court had relied on Singh Ram (Dead) through legal representatives v. Sheo Ram and Others to allow the appeal filed by the defendants and dismiss the plaintiff's suit.

- The Court referred to the three-judge Bench judgment in Singh Ram Case (2014), which established the legal principle regarding limitation in usufructuary mortgages.

- The Court observed that in usufructuary mortgages, the period of limitation does not run from the date of creation of the mortgage but from the date of payment of mortgage money.

- The limitation period begins either from payment out of the usufruct, partly out of the usufruct, or partly on payment or deposit by the mortgagor as provided under Section 52 of the Transfer of Property Act, 1882.

- Until such payment or tender, the period of limitation would not start under Section 61(a) of the Schedule to the Limitation Act.

- The Court held that mere expiry of the prescribed period could not extinguish the mortgagor's right of redemption, and thereby the right of the mortgagee to seek declaration of title and ownership over the mortgage property remains untouched.

- The Court found force in the submissions of the respondents' counsel that applying the ratio of Singh Ram judgment would require dismissal of the plaintiffs' suit and restoration of the Collector's order.

- The Supreme Court dismissed the appeal filed by the plaintiffs, affirmed the High Court judgment, and dismissed the suit.

- The interim order of stay was vacated, and parties were directed to bear their respective costs.

What is Usufructuary Mortgage?

About:

- Mortgage is defined by Section 58 (a) of the Transfer of Property Act, 1882 (TPA) as a transfer of an interest in specific immoveable property for the purpose of securing the payment of money advanced or to be advanced by way of loan, an existing or future debt, or the performance of an engagement which may give rise to a pecuniary (monetary) liability.

- The transferor is called a mortgagor, the transferee a mortgagee; the principal money and interest of which payment is secured for the time being are called the mortgage-money, and the instrument (if any) by which the transfer is affected is called a mortgage-deed.

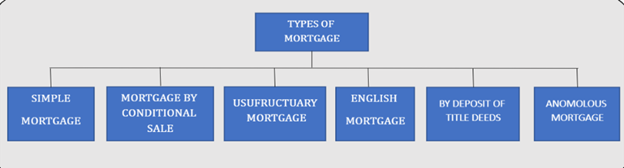

Types of Mortgages:

- Usufructuary Mortgage:

- Section 58(d) of TPA defines usufructuary mortgage.

- It states that where the mortgagor delivers possession or expressly or by implication binds himself to deliver possession of the mortgaged property to the mortgagee, and authorizes him to retain such possession until payment of the mortgage-money, and to receive the rents and profits accruing from the property or any part of such rents and profits and to appropriate the same in lieu of interest, or in payment of the mortgage-money, or partly in lieu of interest or partly in payment of the mortgage-money, the transaction is called an usufructuary mortgage and the mortgagee an usufructuary mortgagee.

- There cannot be two different usufructuary mortgages on the same property at the same time, as the possession can only be given to one only.

- In this type of mortgage, the mortgagee has the advantage to repay himself.